Can We Transfer Money From Forex Card to Bank Account

Josh has been writing content online for over 5 years and has millions of views. He creates content on tech, fitness, money, and family.

Discover how to avoid fees and interest while transferring money from your credit card to your bank account.

How to Transfer Money Into a Bank Account From a Credit Card

We have all had an emergency when we needed money fast, whether to pay for bills that have come due or to purchase things our family needs.

In some situations, you can't use credit cards as a form of payment. Some of these situations include:

- Mortgages

- Car loans

- Other credit cards (without an approved balance transfer)

- Do-Si-Dos from the local Girl Scout troop

I know budgeting experts will tell you not to use credit to pay for credit, but there are some situations where it will save you money.

So how can you use your credit card to deposit money into your bank account?

Pay Yourself With Your Credit Card to Transfer Money to Your Checking Account

To transfer money from your credit card into your checking account and avoid large interest rates and fees, you just need to pay yourself using a Square Account.

Square is a service that gives people or businesses the ability to accept credit or debit card payments using their smart device. Signing up for a Square account is fast. And when the sign-up process is done, you will get a free card reader for your iOS or Android device in the mail, which is convenient, although you can accept a limited number of transactions a day by typing them in manually. You can also purchase a card reader at many popular retailers like Target.

By paying yourself through Square, instead of taking out a cash advance or paying for a wire transfer, you can save a lot of money.

Disclaimer: Why You May Not Want to Use My Method

My money hack violates Square's terms of service. Your Square account could be suspended and the payments canceled. It also may violate terms of use for the credit card you are using.

Please read the Square Terms of Service before attempting this money hack.

It's possible that you may still be able to use my method by and be in line with Square's terms of service by providing an approved good or service and using Square to accept the payment from yourself. However, you should still read the terms of service to be sure.

What You Will Need

You will need the following to transfer money from your credit card to your bank account using my Square transfer money hack:

- A smart device (iOS or Android) with an Internet connection

- A Square account

- A bank account (duh, right?)

- An active credit card with available credit

- Ability to wait up to the next business day for the cash (though it may actually deposit on the same day)

- Optional: a Square reader if you can wait more than a day for the cash to deposit

Step-by-Step Explanation

Before attempting to transfer money from your credit card to your bank account, you should first read the "What you will need . . ." section above.

If you already have a Square Account, skip to Step Two.

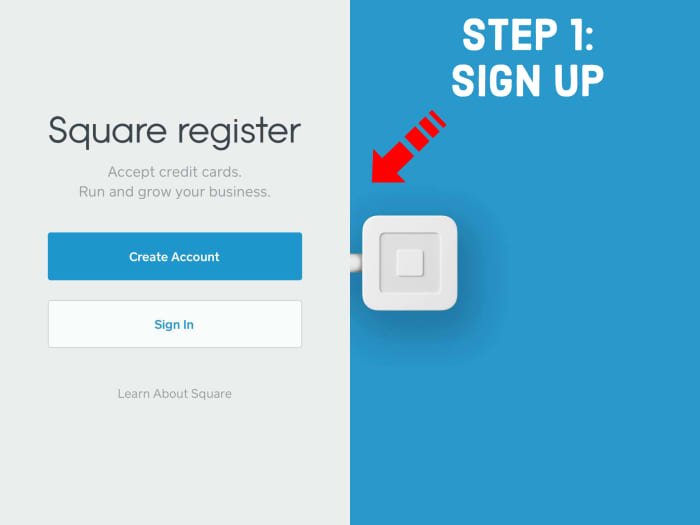

The sign-up screen for a Square account.

Step 1

Sign-up for a Square account. Download the Square App from the Apple or Android App Store. You can also register for Square on your PC or Mac.

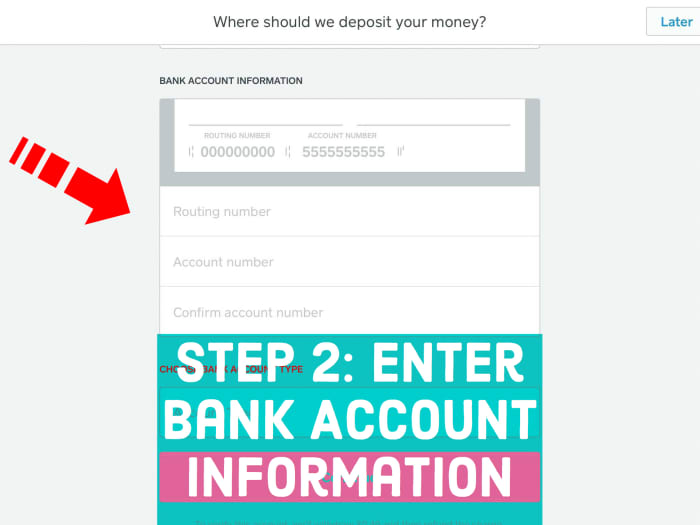

The screen where you enter your bank account info.

Step 2

Ensure the bank account registered to the Square account is the one you need to transfer money to.

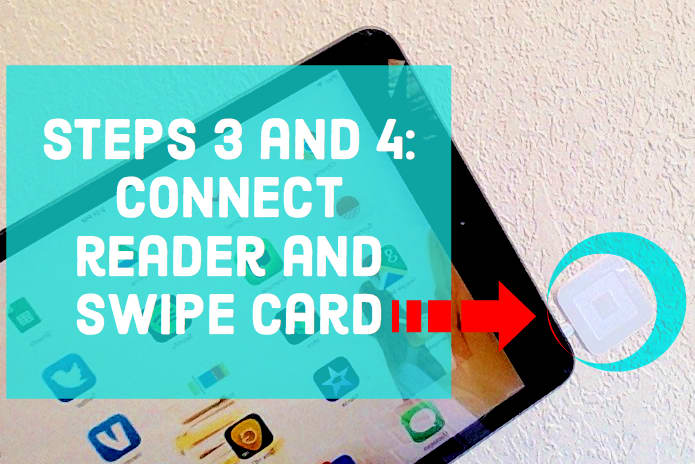

Plugging your reader into your phone.

Step 3

Plug in your Square card reader if available.

Step 4

Swipe your credit card or enter the information manually.

Note: If you type in the credit card information manually, it will take more than 24 hours for the money to deposit into your account. It usually takes three or four days.

Step 5

Submit the payment and confirm. You can opt to send a receipt to yourself from yourself, but I don't think it's needed.

Step 6

Wait for your money to arrive.

Why Using Square Is Probably to Your Financial Advantage

Using this Square hack will most likely be financially better for you than other options. With your Square account, you will only be charged a one-time fee of 2.75% for the purchase. Unlike with a cash advance, you will avoid paying an increased interest rate, and you will still have your grace period to pay the credit off before it gains any interest.

Tip: Only use this money hack if you have to. Do the math and see if it is financially better for you than other choices you have.

How to Calculate How Much Money to Charge Yourself

As mentioned, Square is going to charge 2.75% out of the total sent from the payee (which is you in this case). You will need to adjust the amount you send to account for the 2.75% that will be taken out. So if I needed $40 I would take 40 and divide it by .9725 to find the amount I need to charge myself.

40 / .9725 = 41.1311 (or, rounded up, $41.14).

Thus, I would add $1.14 to the original amount needed of $40.

I would need to pay myself $41.14 through Square to receive the $40 I need.

I hope this helps you—good luck!

Background: How and Why I Found this Hack

For those who are curious, here's how I stumbled on this money hack: I had just finished paying most of my family's monthly bills, and the next day I noticed an unexpected doctor's bill that had automatically drafted earlier than normal.

Since I was a new stay-at-home dad, we were on a pretty tight budget. That surprise bill was going to incur fees that we didn't have the money to pay. At the same time, we had to pay our mortgage the next day, and the fees would leave us almost 40 dollars short.

I had to get money into my checking account, but the banks were closed. I thought of using a wire transfer, since it is the fastest one. A wire transfer would be deposited the same or the next business day, but it had a fee of $25. The whole point was to avoid the overdraft fee of $35, so I didn't think the wire transfer was worth it.

I had a ton of money in my PayPal account, but it takes 3–4 business days to withdraw funds from PayPal.

I could also have used a cash advance offered by my credit card. With the cash advance, however, I would have had to pay a fee of 4% of the total amount advanced, plus I would instantly start incurring an increased percentage rate on the money that had been advanced. It didn't make sense to me.

That's when I started to think outside the box for other options, and this is what I came up with. Remember to read Square's terms of service before trying it out, and good luck!

This article is accurate and true to the best of the author's knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.

© 2013 Josh Woods

Coraline Peters on May 24, 2019:

I tried using square and Walmart's flagged it as a cash advance.

JR on April 13, 2019:

Why just not use paypal?

Travel Chef from Manila on October 20, 2018:

This can be an effective method in case of emergency. However, relying on this method 100% may only result in a mismanagement of one's financial status. It's better to discipline oneself when acquiring or buying stuff. What I mean by that is to buy only according to one's means.

Nena ported on September 29, 2018:

usually MBNA credit card has always a promo of low interest on balance transfer. You can transfer the fund to any financial institution including your own bank account. I used MBNA to this purpose.

Rene on September 28, 2018:

used PayPal, pay a family member with ur credit card n then send the money to your bank accout from their PayPal account, as send money to a friend or fam

Russ on July 05, 2018:

Tried square with a family member and my transaction was flagged and I was forced to do a refund.

GRACIOUS on June 04, 2018:

How do I create a square account?

Arthur on September 01, 2017:

To simplify, Credit Card into Cash is the company that uses a third party company. They have a dot com site. You just use their site as if you are ordering your cash. You save money by not having to open an LLC or corporation and paying unnecessary fees to keep that corporation open. And I was correct on their dropping of processing fees.

If you are receiving your cash via a Chase account, you get charged a lesser fee than whats posted on their site. I hope this helps.

Rob on August 30, 2017:

Arthur...what process do you use and what third party company?

Arthur on August 29, 2017:

I use credit card into cash's method. Just use a third party company to facilitate the purchase (follows terms of use). I've received (borrowed) over $15,000.00 thus far. Process took less than ten minutes online. Got my money the next day. Sometimes the same day. It is a little expensive but it definitely is cheaper than a typical loan. And it's safer than this hack method.

Empy on August 09, 2017:

Didn't work anymore

BusinessOwner on April 02, 2017:

This technique is not necessarily grounds for your account to get banned. The problem lies in the structure of the individual's account. For example, I've done this method more than once with amounts higher than $5000. The only difference is that I have a LLC with it's own Tax ID #, address, name,etc... For those of you who don't know what LLC is, it's pretty much a corporation, and all corporations,LLC, LLP,etc are considered their OWN entity. So in my scenario, I'm not doing anything wrong because the LLC is a business (not an individual) separate from myself (my personal name and credit card). There's nothing stating that I as an individual cannot buy something from my business.

That is why an individual may get their account banned. If YOU (meaning your name,SSN,credit card,etc) are "buying" something from yourself (you better be a legitimate business) or yes, you can be violating some terms. The Square account is associated with your SSN (if you sign up as a person), while signing up as a business will be with a separate Tax ID

Jon on March 23, 2017:

Does not work.

Square requires a DEBIT card, and will not accept a credit card.

kkins on March 06, 2017:

My experience is positive so far. I followed these steps to create an account during this weekend. I then paid myself nearly $3000 with my Sears (Citi) credit card in a single transaction by manual input. I received an email Sunday night from Square stating the funds have been deposited to my bank account minus fees ($100 and some change). Bank account doesn't show anything yet...but it is only 12am Monday.

Now I'm wondering about the $100.xx charge and if I could get that back if I processed a refund for this transaction. I mean, I only need this money temporarily since my money is tied up elsewhere...hmm.

Josh Woods (author) from United States on February 08, 2017:

This is a risky trick, can you please give more detail to your situation. How much money did you attempt to transfer? Who's card, Square account, and bank account did you use? What type of card did you use? What information did Square or your bank provide?

Josh Woods (author) from United States on February 08, 2017:

I personally would not use someone else's bank account to transfer credit funds into through square. There is always the risk that Square or the Bank will catch on to the transaction and freeze an account. Usually, Square just sends a warning or shuts the Square account down. If you didn't see an email from Square, check your junk mail and if it's not there then just ensure that you can log into your Square account using the credentials you created during the registration process. You should be able to manually enter a customer's card information as many times a day as you need, but for manually entered transactions, Square's fee is 3.5% + 15¢ per transaction. Also, manually entering the card info sometimes makes the transaction take longer to process in my experience. What amount is too much to take from each card? Well, it's not just about the card? Square monitors transaction thoroughly and will be looking for anything odd. All of the transfers I have made have been under $100 and using my own card and bank accounts. I have had no trouble with Square. If you read some of the comments for this post, many will say they had issues using more money and some don't give enough detail to help us determine which amounts are being flagged. If your friend with the bank account approves of you using his bank account, I would go ahead and get him to sign up for Square. That way the bank account/Square account and the card being processed are registered to two different people. Your other option is to start providing a legit service or product to accept payments with Square. I hope this helps.

Preston on November 30, 2016:

After reading through all these comments, I'm thinking the best action to being able to do these types of transactions is to have an LLC linked into Square and your personal info to not appear anywhere on Square itself, then link Square to your LLC banking account. If you do all that then you shouldn't have any issues. That way everything is considered a business transaction from you to the business and not from you to yourself. That way you can do the large dollar transactions without any problems.

lauraj7338 on November 29, 2016:

I would NOT use this method! I almost got my credit card and Square account shut down doing this. It may have worked a couple years ago but banks and Square are wise to it.

James on November 10, 2016:

Which other service is better than square ?

James on November 10, 2016:

I just created a square account now and I was told to link an account but I don't have any for now,can I use my friend's account to receive payment? And also after opening an account, I have not receive any emails from them showing a welcome mail or anything to show I just registered. The 3rd questions is, can't I use card manually 4times or more daily depending on purchase and what amount will too much to take from each cards?

Josh Woods (author) from United States on October 10, 2016:

Mike Noa, You should add any income received on your taxes.

Josh Woods (author) from United States on October 10, 2016:

Amanda, that is a horrible situation. The larger the amount of money the more likely an account will be closed and money will get tied up. I hope this all worked out. Who used their card to pay and who used their square account. From what I can gather it seems this was a legitimate transaction. If your taking payment from someone for a approve service then there really shouldn't be an issue. Square must have seen something that made them think the account was a risk - I wish they would have been specific, because that would give the account holder the chance to explain the issue. Sorry to hear this occurred.

Josh Woods (author) from United States on October 10, 2016:

Fo Je, no up front taxes are involved if you don't choose to charge taxes when accepting the payment, but the income should be reported on your taxes.

Josh Woods (author) from United States on October 10, 2016:

You can make a payment without the reader by entering the card info, but it will take longer to process and have a higher chance of getting your account flagged. Payments made without the reader are more heavily scrutinized.

Josh Woods (author) from United States on October 10, 2016:

Mr Falafel, the general rule is you should include all income on your taxes. Even though the money you are getting paid is originating from your own credit card, it has been paid using a payment service.

Josh Woods (author) from United States on October 09, 2016:

Ben, If you are using this technique multiple times or for large sums of money...anything over $100, you have an very high chance of having your account banned. Use caution.

Ben on October 08, 2016:

Hi. I actually thought of this before I found this article. But I started searching for additional information because I'm afraid that Square may flag my account if I try to use it for my intended purpose. No fraud. I just have a large total credit spread over 7 or 8 credit cards. I want to take out the cash for the ones that I can't get 0% APR for cash advances. Looking at a several large transactions. Will Square flag me. Will my money get tied up...is there another option...

Mike Noa on October 07, 2016:

Will this effect my taxation, thanks

Amanda Bjork on October 06, 2016:

I wasn't using Square to hack but found this in a search when my account was terminated.

I am singing/performing at a wedding for close friends. I also have done much work on the wedding planning itself. My friends and I agreed on a sum of $3162 to include travel, hotel, equipment, performance, and planning services. They are paying upwards of $25000 for this wedding and are at the point where they needed to use credit cards to finalize payments. So I opened a Square account today in order to facilitate payment because it was recommended to me and boasted "instant deposit". And because I wanted to use it in the future, deciding that my band will have other performances at parties and such if this one went well.

Payment went through fine, linked my bank account and debit card with no issue. Then a few minutes later they wanted verification. So I sent my ID, an explanation of the payment, THREE bank statements, and had the couple send me an email to use as an invoice, a breakdown of charges. I called and spoke to a representative who said it all looked good and I would hear back by tomorrow. Not even 10 minutes later I was informed that my account was shut down with the following email:

We're sorry to inform you that we are deactivating your account. Our Account Services team reviewed your account and found a pattern of transactions associated with high-risk activity.

For further information about our policies, you can review section 36 of the Square Payment Terms.

We regret that, starting today, you will no longer be able to process transactions using Square. Any funds currently in your account will be held for 90 days before being released to your linked bank account.

If you'd prefer to receive funds more quickly, you should consider refunding the payments back to the original cards and seeking alternate forms of payment. (Please note that we will refund all the fees, too.)

Refunds are available within 60 days of the original payment. To process a refund, log in to the Square dashboard.

Use the date selector tool to locate the specific payment.

Click the payment you'd like to refund, then click "Issue Refund".

Select the reason you're refunding the payment, and click "Issue Refund."

Unfortunately, our decision to deactivate your account is final. Due to security reasons and the obligations of our agreements with card networks and other financial institutions, we cannot reverse this decision and are unable to provide additional details.

Again, we apologize for any inconvenience this may have caused.

Sincerely,

Square Account Services

Not only is this ridiculous AND ruins my friends wedding, but their email contradicts their own terms of service. And my payment did not violate the terms of service in any way. The only possible risk I could see was that I was communicating with them via my work computer, which is on a VPN so the IP addresses and time zones would be off. But that is it. I made no other transactions and now may or may not get the funds in time to make the wedding.

The couple and myself are going to be hounding them all day tomorrow to see if they will deposit the funds. I don't want my account reinstated, but if that happens I will update that.

Fo Je on September 28, 2016:

Any taxes involved? Will I be audited for taxes?

MR FALAFEL on September 24, 2016:

Seems to be working with CC out of CAN and USA. But the questions really, would you be taxed due to using this service?

Josh Woods (author) from United States on September 01, 2016:

azzoug, if you have an American address you can use then I would go ahead and use that one.

Josh Woods (author) from United States on September 01, 2016:

Chetan & Emmanuel, I am not familiar with Indian bank practices and policies. If either of you try it, please let us know how it worked out.

Josh Woods (author) from United States on September 01, 2016:

Ms. T, I'm glad that this could help. This is the type of reason I think the method should be used for. Sorry you have to deal with a landlord who isn't understanding, but in his their defense they may have been though some bad tenants in the past. Thanks for your comment and have a great day.

Josh Woods (author) from United States on September 01, 2016:

Lee, I would not do this in connection with a card that someone else shares with you without their consent. Using gift cards may work, but most gift cards have a fee when you purchase them. If you or your mother is linked to the account and you use the card there is always the chance square will shut down your account.

Lee on August 29, 2016:

Lifefusion do you think that it will cause any issues if I have the money deposited into my business checking account. (LLC)

I was also wondering if I should buy gift cards with a credit card or use my mother has all of my credit cards in her name as a authorized user. I was going to charge $1000 to her card which my SSN is on the account. Josh ? Anyone ?

Preston on August 01, 2016:

Just a thought, but also a possible solution. Most credit card companies allow you to have 2 cards linked (i.e. I have a card in my name and my mom has one in her name, and we share the credit limit). So the solution would be to use my moms card to pay into my account so that the name on the transaction is different. And if asked will just tell them she is paying me for taking care of her. Am I wrong in that thought?

Chetan Kulkarni on August 01, 2016:

Hey Wil this method work in India. I mean for Indian banks?

Ms. T on July 09, 2016:

This was an absolute life saver!!! I just paid my rent doing this Lifefusion you are a genius! My landlord sent me an email threatening possible eviction, unbelievable I paid you on time for 3 years and twice i'm late, you're getting your late fees so why bring up eviction? Makes me want to move out just because I feel she has no heart. Slumlord never even put a washer dryer in my unit as she said she would. It is what it is, hope things will get better in a hurry.

Jon on July 01, 2016:

I tried with square but they caught me. Has anyone tried Quickbooks Payment?

G pain on June 19, 2016:

I think u can only use 1 card and you will be fine if u doing more than one there's your problem

Josh Woods (author) from United States on June 08, 2016:

liljon50 - Yeah, Square has some quirks. It seems like the more money being paid the more likely that transaction will be red flagged by Square. I am currently researching how to a square account reinstated. The longest a payment of any kind has taken to process for me is 5 days. The few times I have used the transfer hack it processed by the next day. The largest amount I transferred was $150. Was the card you used to transfer in your name? If not you may be able to call square and get them to push the payment through and reinstate your account. A friend of mines account was suspended and the payment was on hold. Since he used his wife's card he just called and explained that she was paying him for moving services because they were getting divorced. The CS agent pushed it through. Maybe something like that might help.

Josh Woods (author) from United States on June 08, 2016:

dnile28 - It would be harder for Square to catch your violation if you use any card not linked to you in some way (Name, Address,...) If its a cared that's not registered to a person then I would highly doubt any red flags would be raised. That being said, I have had a few clients that tried to pay me with gift cards and square took longer to give me the payment. It seemed like the MasterCard gift cards took longer to process.

liljon50 on June 06, 2016:

I actually did this some months ago. I thought it stopped working. I never bothered to actually check my credit cards balance after though. I was using the phone app. So i figured if it didn't go into my account it didn't come out the other account. Err... Wrong.. It wasn't until I logged onto the PC I saw my account "needed to be verified" They verified me, I kept waiting though for my funds. I had $300 some odd waiting for deposit. They sent me an email about 2 weeks ago saying my account has been deleted. I should refund the money back to the original card. Or after 30 days it will go into my bank account. Isn't that the whole reason I did it?

It was some of my cards, as well as my wife. We both worked the same job so we split bills 50/50

With all that said, did anyone else have to wait this 30 days? Or they had no funds being processed at the time. I feel like even after the 30 days it will still sit in there.

dnile28 on June 05, 2016:

Ok, here's a question. what if I got a visa/amex gift card and put the amount of money that I wanted on the gift card, then used my square account to deposit the cash to myself... would that be harder for square to find me in violation? can i even get a gift card with a CC?

Josh Woods (author) from United States on June 01, 2016:

Mike, the process does still work. As mentioned in the disclaimer section though, you may not want to use this process because it does violate Squares terms of service. I still have never had an issue. I only do this when I really need to and I also use my reader to let clients pay me for services. I have actual service transactions and the rare card transfer hack transaction. I have had my square account from the beginning and its still active today. Be smart with it.

Mike on May 31, 2016:

This doesn't work anymore. They are cracking down on this as a lot of people have become wise to the method. I wouldn't suggest trying it if you use square often. Of they remove your account, you're out of luck

ryan on May 15, 2016:

just use your head, and dont be a fool and swipe 1000 on your first sale, even if its your own card...

lam on May 11, 2016:

i did this and they shut down my account

Emmanuel Leorn on February 10, 2016:

Hi ,

I live in India and can I do this with Square , I have a Credit Card and bank Account with the same bank , Please advise.

azzoug on December 04, 2015:

Hello

Thread interesting and useful.

My question is: I am my card. Issued by a European country. (My address)

I have a bank account in America.

When you open an account with : Square

Do you put America or Europe address?

jchan on November 22, 2015:

I've been doing this for years to transfer gift cards to my account. I did it when I accidentally double paid a bill on my Discover card and then just swiped the card to pay myself for the overage. I haven't used it in a few months now so I don't know if it would still work.

Josh Woods (author) from United States on October 08, 2015:

Mig, Square may be cracking down even more. Like I mention above, it's risky. You could always provide a legitimate product service to someone for payment to be safe. If you don't mind, could you share what happened. What did Square say? How did they notify you?

Mlg on October 08, 2015:

I tried and i was caught

Josh Woods (author) from United States on October 07, 2015:

You are charged 2.75% for each transaction, thus you would be charged about $2.75 for a $100 transaction. you would need to make the transaction for $103 if you want $100...it will be slightly more than $100.

vandana on October 06, 2015:

is this is all true? just tell me for 100rs how much ou willl be charged?

mlg on October 05, 2015:

It's asking me to verify payment method...if I used my own credit card to myself, how in the world do I prove it without being blown out the water, and the money not going through?

Josh Woods (author) from United States on July 02, 2015:

Thanks Random 149.16, just remember it may violate Terms and Conditions for your Credit Card and/or Square service. Hope it was helpful.

Random on June 30, 2015:

Sure you are a genius and I could kiss you

Josh Woods (author) from United States on June 10, 2015:

I think it is now called Square Register on the Google Play Store

i dont know how to use the square :( on June 06, 2015:

Can't find it how can i enter my account number and where . Is it the square up app

Keith on June 01, 2015:

Here is the email that was sent to me from Square:

Hello Keith,

We reviewed your account and found some payments that violate the Square Terms of Service. As a result, we won't be able to deposit funds for these payments into your account. We apologize for any inconvenience this may cause.

Under our Terms of Service, you cannot process prepaid cards, gift cards, or your own credit card using your Square account. The Square Terms of Service also prohibit using Square as a money transfer system. You must provide a legitimate good or service in exchange for every payment processed with Square.

Please refund the payments in question. If you aren't sure how to refund a payment, this Support Center article will help you. It usually takes two to seven days for refunded payments to get credited back to the original payment card.

Please understand that if you process these types of payments again, we'll have to deactivate your Square account.

Thank you for understanding.

Sincerely,

Square Account Services

Keith on June 01, 2015:

Hello, thanks for posting this article. I have successfully made 3 transactions with my new Square account and had the money deposited. However, after the fourth try, Square stopped the transfer and requested a legitimate business ID and proof of all of my invoices. I could not produce them so they canceled the transactions and warned me that I was in violation of their usage rules by using my own credit card to transfer money to myself. Was cool while it lasted!

$Man on March 18, 2014:

Would this work for large purchases for the sake of showing large credit card activity to get a say $10,000 secured credit card unsecured?

ed on December 17, 2013:

ok, all depends but for sure square up reports to the IRS.

its on there website 10-99 form is send out by square up reporting that you have made xxxxx amount

Josh Woods (author) from United States on December 12, 2013:

I am not sure about that. I would think any additional income should be reported, but with the money actually stemming from your own credit account that makes it complicated. I will try to look into this more, but for my purposes (getting quick cash to avoid large late fees) it would still be well worth it even when factoring in claiming the income on my taxes.

ed on December 11, 2013:

what about taxes or now you have additional income paying your self ??

Josh Woods (author) from United States on October 28, 2013:

You are correct. Thanks for pointing out the error. My old Finance 3100 professor would be ashamed.

Chase on October 28, 2013:

Your math is a little off, if you do it your way and charge 40 +1.1 (41.10) that will be charged 2.75% or 1.13 and you will be left with 39.97 not 40. You need to actually take the amount you want to charge and divide it by .9725. $40 / .9725 = $41.13. So when they take 2.75% of your total (1.13) you are now left with $40.

Josh Woods (author) from United States on October 02, 2013:

I am glad this could help you out. It is a nice little trick.

mimi67 on October 02, 2013:

This worked like an absolute CHARM. I can't thank you enough! I followed your instructions to the letter - signed up for Square on my phone at 9:00p on Monday, manually entered a credit card payment to myself, and voila! There it was in my bank account Wednesday morning. THANK YOU !!!!

Can We Transfer Money From Forex Card to Bank Account

Source: https://toughnickel.com/personal-finance/how-can-i-transfer-money-from-my-credit-card-to-bank-account-Fast-and-Low-Cost-Without-Cash-Advance-or-Wire-Transfer

0 Response to "Can We Transfer Money From Forex Card to Bank Account"

Post a Comment